Up to $25,000 available to Montgomery County home buyers

Montgomery Homeownership Program VI - Open as of July 28, 2021 *******PROGRAM CLOSED. FUNDS EXHAUSTED AS OF OCTOBER 22, 2021******* The Montgomery Homeownership Program is an initiative of the Maryland Mortgage Program in partnership with Montgomery County, which offers eligible home buyers who purchase in…

Should I refinance?

When considering refinancing your mortgage, be sure that your decision is based on more than just the lower rate. Sure, rate plays a part, but you also need to see what the actual savings is vs. the cost of the refinance. Before you move forward…

Big changes to VA home loans in 2020

Beginning January 2020, loan limit changes are happening! The maximum loan limit, starting January 2020, will be $1,500,000 across the country (no longer State or County specific). *Borrowers with partial VA Eligibility will want to review with me the amount they can purchase with no…

Conforming Loan Limits to Rise in 2020

Some good news for those looking to purchase a home in 2020!!! The Federal Housing Finance Agency has announced that the maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac will rise in 2020. Old conforming loan limit -…

Mortgage rates continue to confuse consumers

Mortgage rates are a popular topic online and in the news. These days, information travels fast and everyone seems to be an expert on the topic of mortgage rates. The trouble with all this information flying around is that much of it is inaccurate, or…

Maryland Mortgage Program adds new Flex loan options to help more buyers

The Maryland Mortgage Program (MMP) has always been geared toward helping first time home buyers in Maryland with down payment and closing cost assistance. MMP defines a first time home buyer as a person who has not owned a home in the most recent three…

When is mortgage interest tax deductible now?

In years past, mortgage interest has been tax deductible for a large majority of home owners, however with the new tax law changes in 2018, not as many home owners will be writing off their mortgage interest. Here is the inside scoop: DO YOU ITEMIZE…

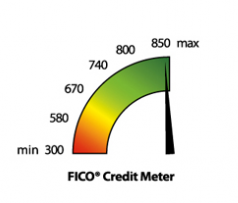

Don’t trust your online credit score

Since the start of 2017, the Consumer Financial Protection Bureau (CFPB) has cracked down on all three credit bureaus for deceiving consumers with the credit scores that they were paid to provide. The credit scores that were provided to consumers were said to be the…