Eligible home buyers will be exempt from paying property taxes for the first five years. The five-year period Tax Abatement begins on October 1, after the deed has been recorded and a complete application has been submitted.

Eligible home buyers will also be exempt from paying recordation taxes and will also receive a credit from the seller for their portion of the transfer taxes. Transfer & recordation taxes in Washington D.C. are 2.2% (split evenly between buyer and seller typically) for sales prices lower than $400,000 and 2.9% for sales prices of $400,000 or greater.

Minimum home owner requirements:

- The property must be owner-occupied;

- The owner must meet the income level requirement; and

- Maximum sales price limit is $479,066

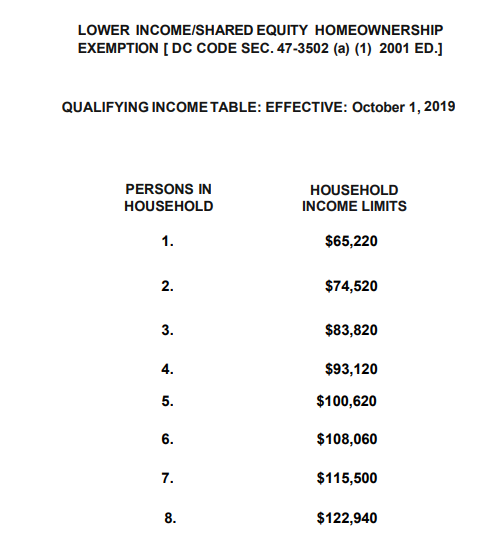

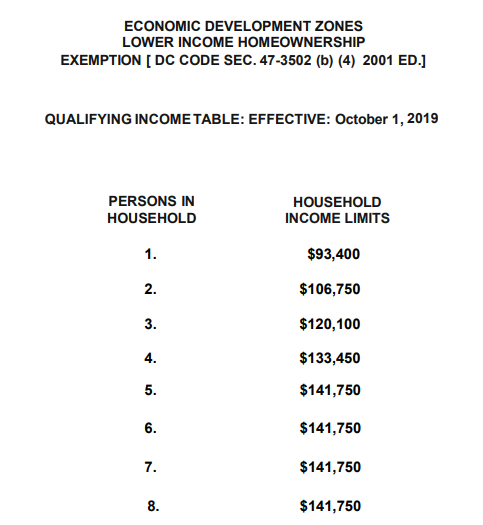

Current total household income limits apply to all those living in the property.

QUESTIONS?

Click HERE to connect with us, or to have us contact you

Curious if you qualify? – Call or email us directly, or Pre-Qualify Here

Call us at (240) 670-5090 or email us at CJMT@mainstreethl.com

Lower Income, Long-Term Homeowners Tax Credit

For more information, call the Recorder of Deeds at (202) 727-5374.

For additional information, you may contact the Office of Tax & Revenue at 202-727-4829, 202-442-6712 or 202-442-6644.

For a copy of the latest abatement regulations and application click HERE.