Sourcing funds is one of the most cumbersome and time consuming aspects of the mortgage approval process. Lenders must verify where your cash is coming from and document any non-payroll large deposits, or unusual recurring deposits. Typically, a large deposit would be anything $1000 or more, but it depends on what is customary for that person based on their income & profession.

If you are planning to apply for a mortgage, DON’T DO THE FOLLOWING:

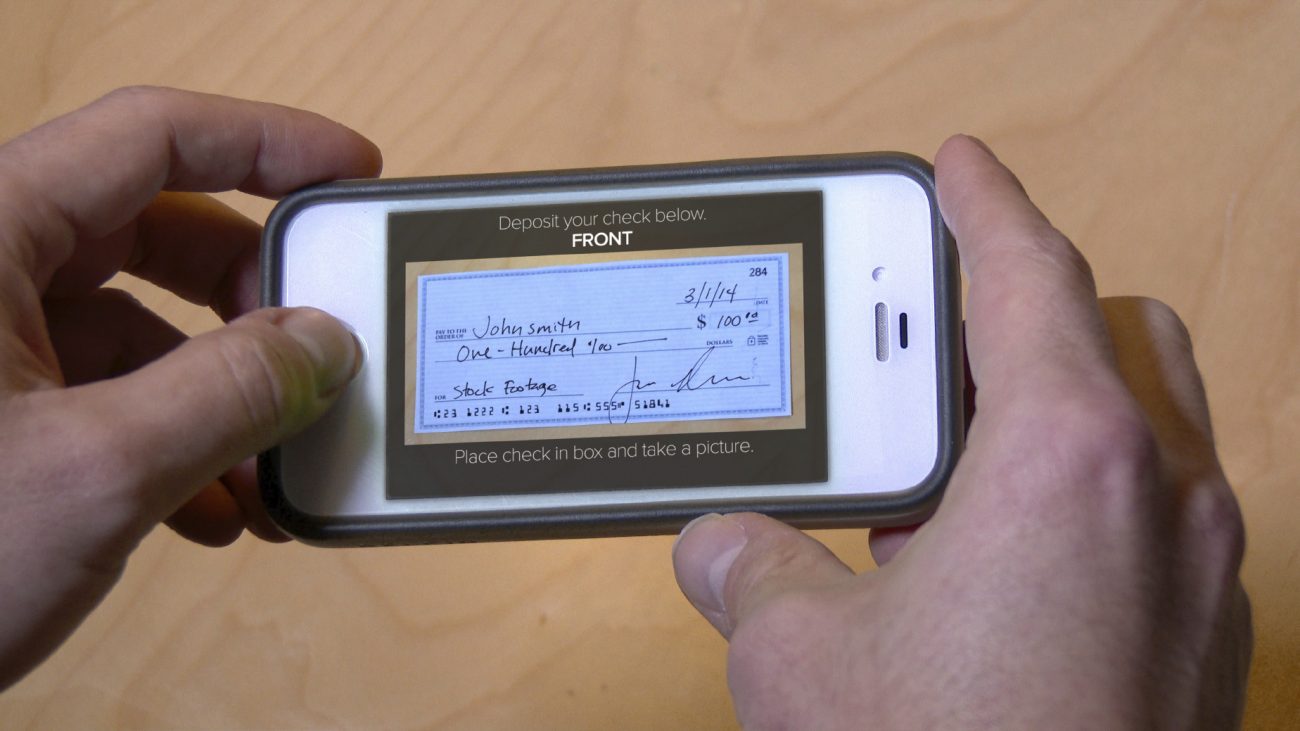

- Don’t deposit checks without making a copy – This is especially an issue when depositing several checks together as you may find with wedding, or birthday gift situations. Be sure to make copies of all checks before depositing and keep a copy of the deposit slip as well.

- Don’t deposit large sums of cash – Cash on hand that cannot be documented is ineligible.

- Don’t move money back and forth between accounts –this causes a paper trail nightmare.

- Don’t open new accounts with funds that cannot be sourced

- Don’t receive gift funds without first getting instructions as to how it must be documented from your loan officer

Moving money around between your accounts is common, but you need to be sure you do it the right way. The easiest and least complicated route is to not move money around once you pre-qualify. Once your loan has been fully approved, we can advise you that it’s all clear to move funds around prior to settlement if you need to.

QUESTIONS?

Click HERE to connect with us, or to have us contact you

Curious if you qualify? – Call or email us directly, or Pre-Qualify Here

Call us at (240) 670-5090 or email us at CJMT@mainstreethl.com